PS Broker Was Trustworthy and Sensitive to Our Needs

September 1, 2022

Matterport 3D Virtual Tours

September 20, 2022Why You Should Buy a Veterinary Practice

Why You Should Buy a Vet Practice:

Financial Education on Veterinary Practice Ownership

Getting into veterinary school is a huge accomplishment. From crunching hours studying while also working part-time jobs, the decision to become a veterinarian asks for immense sacrifices of both time and money. However, it can also be one of the most rewarding professions in the world. However, one thing that is probably on your mind is the ominous student debt.

We completely know what you are facing and that is why we asked Dr. Bonnie Bragdon, DVM, MS, to share her experience. Dr. Bragdon offered invaluable advice that she wishes someone had given her back when she was an undergraduate student, including why buying a vet practice can be beneficial.

Practice Ownership May Be the Answer to Your Student Debt

It may sound unsustainable; adding more money to your already high student debt doesn’t seem like a viable plan. “These days, veterinarians graduate with, on average, greater than $200,000 in student debt. Research shows that debt undermines financial health, job satisfaction, and emotional well-being,” says Dr. Bragdon. Even Dr. Bragdon’s experience wasn’t much different — she graduated with a huge amount of student debt.

“So, what’s my advice? Consider practice ownership. I know, I know you’re saying to yourself, ‘but I’m a science geek. I know biology. I don’t know how to be a business owner.’ I promise, if you can understand the Krebs Cycle and can get through organic chemistry, I promise you can learn to read a profit and loss statement and understand the future value of money,” Dr. Bragdon explains.

Career Opportunities for Veterinarians: Working as an Associate vs. Practice Ownership

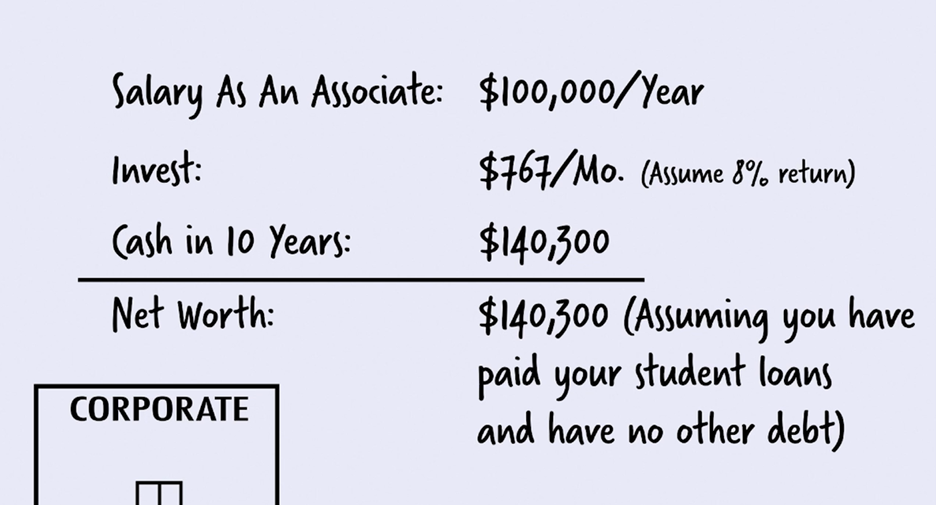

Let’s go over two possible veterinary career scenarios. The first, traditional one is to become an associate in a corporate practice. Let’s assume that you would be making $100,000 a year.

If you invest 10% of your salary after taxes (so just over $760 per month for ten years) and you assume an 8% return on your savings, you’ve accumulated just over $140,000. Not too shabby after living the life of a poor student, right?

Now, let us look at the numbers if you decide to take the path of practice ownership.

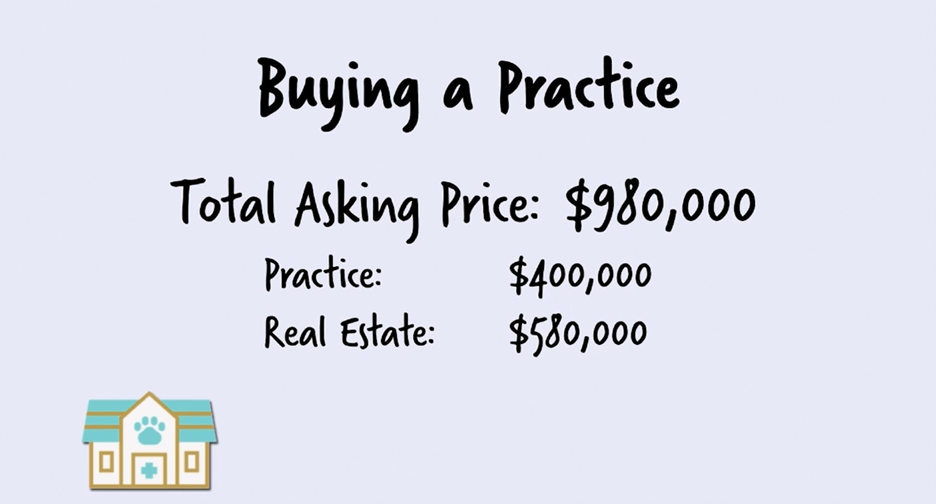

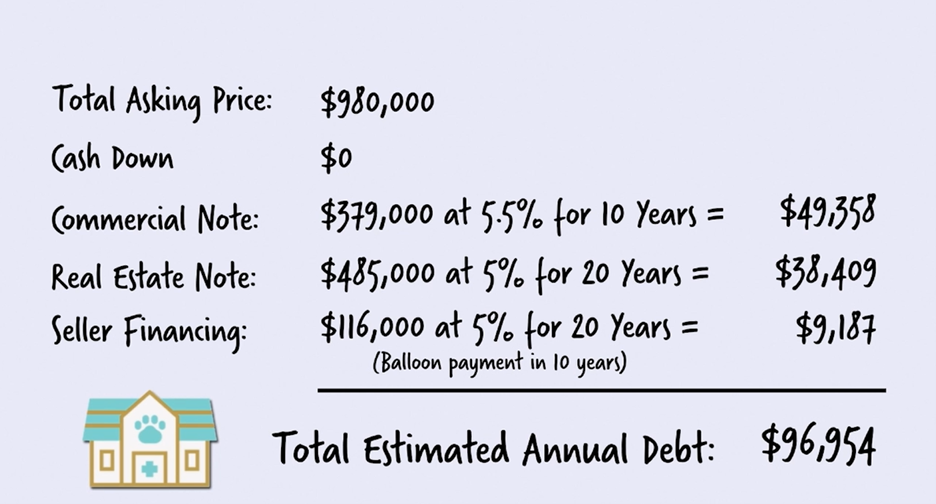

The total asking price for the practice is, let’s say, $980,000. $400,000 would be for the practice and $580,000 for the real estate. How can you ever afford that much money with high student debt? How are you ever going to save for that down payment? Well, you can get a loan with zero down.

How is that possible, you may be wondering?

Easy. Many owners are planning their retirement at the same time you are thinking about taking up the responsibility of becoming an owner. “Many owners who are anxious to retire will help you with the down payment. You can indeed buy a practice with no money down,” says Dr. Bragdon.

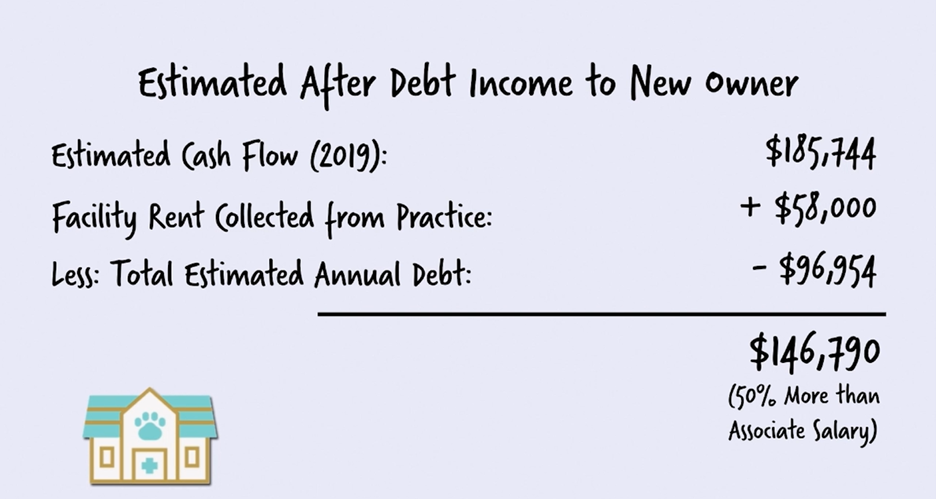

But, there is still a question of paying that extra $96,000 in debt every year.

Is it really wise to add more money to your student debt?

“After paying your debt and other expenses, you could take a salary of over $146,000 per year, already almost 50% greater than your salary as an associate and the practice pays for the additional debt – not you,” explains Dr. Bragdon. “Now, how much would you be worth? After 10 years of paying yourself a higher salary, investing 10% of your salary, and building equity in the practice, you would be a millionaire. Yes, a millionaire!”

After 10 years of practice ownership, the practice would pay for the loan, and you would have an additional $49,358 you could take as a salary. Plus, it could be used as a payment for your cell phone, automobile, and many other benefits, all from top line revenue as an expense to the practice before paying taxes.

As you can see, a decision to buy a vet practice is a very real and viable option for helping pay off student debt and live a financially sustainable life.

Preparing for Practice Ownership

So, what can you do to prepare for becoming an owner of a veterinary practice?

Dr. Bragdon has some additional advice for you: “First, live within your means and borrow responsibly. Second, take undergraduate classes in finance and business administration. Third, seek management opportunities in your current setting — that is, seek to manage others.”

These steps will help you grasp the necessary skills needed for running a successful business.

A final word of advice from Dr. Bragdon is to join her at the Independent Veterinary Practitioners Association. Student membership is free, and they are working hard to create content to keep you up to date and prepare you for practice ownership. “I wish you the best of luck in your studies. I have faith you will succeed, and I look forward to being able to welcome you into the wonderful profession of veterinary medicine,” says Dr. Bragdon.

PS Broker wishes all veterinary students good luck and success in your future endeavors. Once you’re ready to dip your toes in the world of veterinary practice ownership, PS Broker will be there to help you choose the perfect one!